Describe the Three Main Taxing Authorities in the United States

In 1985 the federal government levied a tax of 24 cents per pound on snuff 8 cents per pound on chewing tobacco and 45 cents per pound on pipe tobacco. The McNamara-OHara Service Contract Act which sets wage rates and other labor standards for employees of contractors furnishing services to the federal government.

Tax Base Definition What Is A Tax Base Taxedu

Over the last decade the United States has shifted its stated drug control policy toward a comprehensive approach.

. These taxes may be imp. A system of checks and balances prevents any one of these separate powers from becoming dominant. These are the main agencies of the federal government.

If a family receives benefits from major programs such as food stamps public housing section 8 housing the refundable earned income tax credit the Women Infants and Children food program. Counties also known as boroughs in Alaska and parishes in Louisiana and municipalities or citiestowns. Established by Article I of.

Key imports from the Philippines are semiconductor devices and. To ensure a separation of powers the US. Regressive proportional and progressive.

The United States and the Philippines have a strong trade and investment relationship with over 189 billion in goods and services traded during 2020. Has an assortment of federal state local and special-purpose governmental jurisdictions. The United States firmly believes that a robust civil society independent of state control or government involvement- is necessary for democracy to thrive.

United States officially United States of America abbreviated US. Tax systems in the US. Civil society is a source of all-encompassing ideas.

State and Local Tobacco Taxes. Personal income taxes 2. The Walsh-Healey Public Contracts Act which requires payment of minimum wages and other labor standards by contractors providing materials and supplies to the federal government.

Legislative executive and judicial. Comparative Health Care System statistics 1998 for these three countries show that the United States has the highest infant mortality 72 per 1000 and Germany has the lowest rate 47. Federal income taxes payroll taxes Social Security and Medicare.

The President of the United States administers the Executive Branch of our government. The upper class is considered the top and only the powerful elite get to see the view from there. The federal government of the United States US.

The mortality rate in Canada is 55 per 1000. Tax expenditure budget around the world following its introduction in the United States in the 1970s14 These three functions can even be discerned in the current effort to reform the US. The first three articles establish the three branches of government and their powers.

Open in a separate window. Legislative Congress Executive office of the President and Judicial Federal court system. Federal government or US.

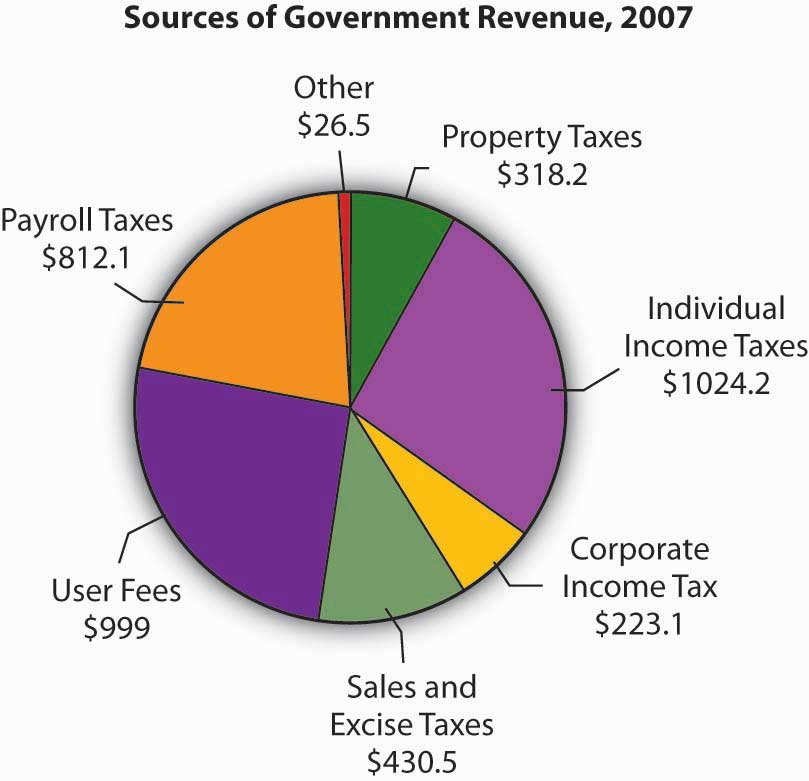

Fall into three main categories. Federal government State and local governments Federal Government Major expenditures are to provide. Two of these systems impact high- and low-income earners differently.

The heads of these 15 agencies are also members of the presidents cabinet. Federal authority to control these substances primarily resides with the Attorney General of the United States. The United States is one of the worlds leading producers of energy.

1Goods and services 2Social security and welfare benefits 3Transfers to state and local governments 24 CIRCULAR FLOWS The main taxes paid to the federal government are. The two guidelines that President Bush gave to the Tax Reform Panel were revenue neutrality any reform. The President enforces the laws that the Legislative Branch Congress makes.

Local governments generally include two tiers. Or USA byname America country in North America a federal republic of 50 states. To ensure the government is effective and citizens rights are protected each branch has its own powers and responsibilities including working with.

Office of the United States Trade Representative. Besides the 48 conterminous states that occupy the middle latitudes of the continent the United States includes the state of Alaska at the northwestern extreme of North America and the island state of. Each imposes taxes to fully or partly fund its operations.

One that focuses on prevention treatment and enforcement. History civil society organizations have played a key role in protecting human rights and advancing human progress. As of 1993 federal taxes on snuff chewing tobacco and pipe tobacco are 36 12 and 675 cents per pound respectively4.

Generally three types of taxes will show up on a workers pay stub. They are the Executive President and about 5000000 workers Legislative Senate and House of Representatives and Judicial Supreme Court and lower Courts. Government is the national government of the United States a federal republic in North America composed of 50 states a city within a federal district the city of Washington in the District of Columbia where the entire federal government is based five major self-governing territories and several island.

The Philippines third-largest trading partner the United States is one of the largest foreign investors in the Philippines. Two of these systems. Use of many intoxicants.

Federal Government is made up of three branches. From the earliest days of US. It relies on other countries for many energy sourcespetroleum products in particular.

In the United States people with extreme wealth make up one percent of the population and they own roughly one-third of the countrys wealth Beeghley 2008. State and Local Government. Money provides not just access to material goods but also access to a lot of power.

Corporate business taxes 3. It was long the worlds biggest consumer of energy until it was passed by China in the early 21st century.

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Comments

Post a Comment